Airmic insurance spend rises but salaries fall

What is the best paid sector for risk managers? How much do risk managers spend on broker services? What does a typical Airmic member look like? Airmic has revealed the results of its biennial Salary and Status Survey, read the highlights here.

The industrial and manufacturing sector is the most lucrative industry for risk managers, according to Airmic's 2016 Salary and Status Survey, which also revealed an overall fall in salaries across almost all age groups.

Airmic members in the industrial and manufacturing sector receive, on average, a total remuneration package (salary plus bonus) of £133,357, the survey showed. Financial institutions was the second most lucrative sector with an average of £125,344, while average incomes in the food, drink and tobacco sector came in third place at £125,220.

Education was the lowest paid sector for risk professionals, with an average remuneration of £47,000.

Airmic's Salary and Status Survey is conducted of its members every two years, and provides a snapshot of insurance buying trends, a profile of today's risk professionals and a gauge of salary levels within the risk management profession.

A total of 246 Airmic members completed the survey, which represents over 20% of the membership as at November 2016.

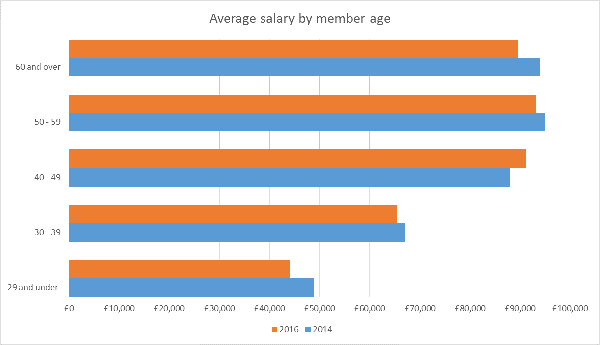

The survey showed a marked fall in average salaries across all age groups, with the exception of the 40-49 age bracket, which has seen average salaries rise from £88,000 to £91,000.

Airmic said the fall in average salaries can in part be explained by a higher-than-usual number of very senior members retiring; however, more investigation is needed to understand what is driving lower salaries in under-forties.

As with previous years, members' salaries peak in their fifties at £93,000. However, the gap in earning potential between members in their forties and fifties has narrowed to just £2,000.

The survey also revealed that the estimated total annual insurance spend for Airmic members has increased to £6.8 billion (excluding self-retained and captive insurance) – an average of £15.5 million per member company*. This is a significant increase from the estimated £5 billion total spend in 2014.

Airmic's research and development manager, Georgina Wainwright, commented: "We have to remember these numbers are estimates based on a sample of Airmic members, but the overall trend is still clear."

She added: "The reasons for higher spend on insurance in a soft market are not immediately obvious. It is partly explained by growth in Airmic membership, but more research will be needed to ascertain whether other factors, such as growth in new classes of cover, are at play."

In total, Airmic members spent an estimated £275 million on broker fees in 2016. Total spend on risk management services was an estimated £58 million. The association said this was the first year they have asked these questions so no comparative data is available.

The biannual survey paints a picture of the changing profile of the "typical" Airmic member. This year's survey showed, for example, that although a high proportion of members continue to be based in London, the percentage has fallen from 45% to 38% since 2010, with a rising number of members based in the midlands and North West England.

It also showed that while Airmic continues to represent predominantly large companies with a global turnover of over £5 billion, it has seen growth among companies with under a billion pounds global turnover.

"Airmic has, for some years, been trying to be less London-centric in its appeal and to attract a wider range of organisations, so these survey results are encouraging," Wainwright said. "It suggests we are making progress."

The full Salary and Status report will be available this month.

*The total insurance spend is an estimated figure, and based on a calculation which assumes that the 246 respondents were representative of the total Airmic membership.