Airmic runs a blend of online and face to face sessions. Where workshops are to be delivered online, these are marked as ONLINE in the list below. All other sessions will be face to face sessions. All sessions can be registered for by clicking on the link for the relevant session. Live sessions are listed below and on the calendar to the right

On Demand sessions covering a wide range of topics can be found in the Library section of the website.

Sessions and events from Airmic with a specific insurance focus and accredited by the CII are indicated below against relevant sessions under 'More Info'.

Next Session:

The building blocks of successful and sustainable business operations are an effective strategy and clear corporate purpose that demonstrate the values the organisation wishes to deliver against. Risk professionals need to understand this wider context in order to be effective business partners, help raise the profile of risk management, and to have real influence at boardroom level.

Future Sessions:

In 2025, global risks to business will be driven by power vacuums and polarisation, conflict and violence, and the double-edged sword of technological advancement. RiskMap is the annual forecast of business risks compiled by Control Risks experts worldwide. With risk ratings and in-depth analysis, RiskMap is your guide to mitigating risk and seizing opportunity in the year ahead.

The Airmic Risk Management Fundamentals (RMF) course, delivered virtually over three half days, will equip you and your organisation with the essential knowledge and skills to navigate the increasingly complex world of risk.

The 25th anniversary edition of the Edelman Trust Barometer has revealed a profound shift to acceptance of aggressive action, with political polarisation and deepening fears giving rise to a widespread sense of grievance. What can organisations and businesses do?

The annual World Economic Forum’s Global Risks Report, developed in collaboration with Marsh and Zurich, explores some of the most severe risks we may face over the next decade, against a backdrop of rapid technological change, economic uncertainty, a warming planet and conflict.

There are four parts to the business model: organisations define value, create it, deliver it and capture residual value. Stakeholders who provide resources and help turn them into outputs (e.g. suppliers and employees) are key for value creation; however, customers are the stakeholders to whom value is delivered. The organisation captures residual value to share among providers of capital, government, senior executives and for reinvestment. The parts of the business model are linked and aligned. Risk professionals have an opportunity to engage with all parts of the model.

The Airmic Risk Management Fundamentals (RMF) course, delivered virtually over three half days, will equip you and your organisation with the essential knowledge and skills to navigate the increasingly complex world of risk.

The Airmic Risk Management Fundamentals (RMF) course, delivered virtually over three half days, will equip you and your organisation with the essential knowledge and skills to navigate the increasingly complex world of risk.

Business acumen is more than finance, but financial literacy is a good place to start. Financial literacy will help determine challenges and questions before seeking answers, and a grasp of finance metrics and language will help raise risk professional’s credibility with finance peers. This module will not turn the risk professional into a finance professional, but it will provide signposts for relevant further finance-related learning.

Walking the roads of digital transformation is not an option. Advances affecting customer experience, revenue and cost are increasingly compelling and shape how risk professionals can engage intensely with the strategic, tactical and operational transformation ambitions of organisations.

Context and Focus The world of work is changing more dramatically than ever before with a range of factors transforming the work people do, how they work and where they work. Within this context, organisations continue to grapple with both existing and new challenges regarding effective people management to ensure that employees remain engaged and productive. To protect business value and mitigate people risk, organisations need to maximise the potential of their greatest asset - their talent - through effective talent management, cultural alignment, well-being strategies, and tactics that build employee trust and psychological safety in an increasingly volatile and uncertain world.

A Board should promote the long-term sustainable success of a company by identifying opportunities to create and preserve value, and establishing oversight for the identification and mitigation of risks. Whilst risk-taking is a fundamental driving force in business, the cost of risk management failures is still often underestimated – there remains a cultural challenge in some organisations in getting business leaders to engage fully with risk management. With sustainability issues continually on the rise, every organisation and Board needs to be aware of the risks associated with poor governance and/or an inability to grasp opportunities to improve its environmental and social credentials with all stakeholders. This context presents a challenge for risk professionals moving from backstage to the spotlight.

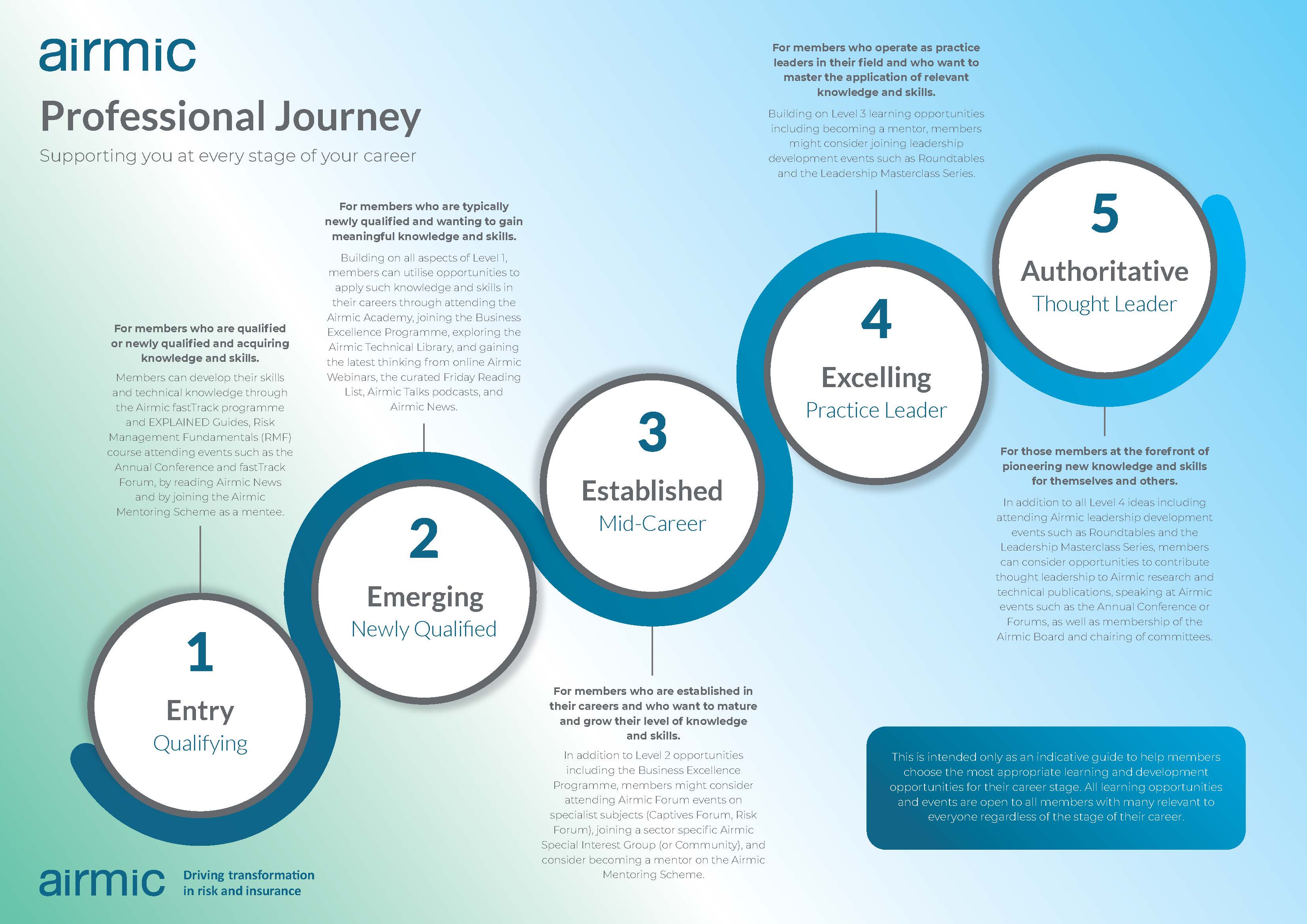

Airmic promotes and supports the planning, undertaking and subsequent recording, of Continuous Professional Development (CPD). Airmic activities offer a range of opportunities to undertake structured and unstructured CPD designed to help professionals build confidence and credibility, adapt to change through continuous skill development, increase productivity, and focus on relevant training and development to support career goals and address gaps in experience, skills and knowledge.

Subject to the CPD scheme an individual belongs to, many Airmic activities are eligible for CPD hours and points, and we would recommend hours are logged accordingly to present as CPD evidence should it be needed to. Wherever possible, Airmic will highlight the potential CPD hours / points available against its relevant activities

A Masterclass Series designed specifically for members holding senior roles in their organisations and wanting to explore the very latest thinking on leadership with peers at five events across the year.

Watch this space for the 2025 Leadership Masterclass Series - coming soon!

A series of online sessions from experts in their field, designed for those in the first four years of their career (although open to all Airmic members) in order to provide a fundamental understanding of, and key competencies in, the principles of risk and insurance management.

Watch this space for the new FastTrack Programnme - coming soon!

A programme designed for the risk professional who is ready to use a foundation of qualifications and experience to move them forward to the next stage of their career.

Airmic runs a series of regular online webinars that explore the latest news and thinking on key emerging topics throughout the year. Scheduled Airmic LIVE sessions can be found in the list of Future Sessions on this page.

Free to members, Airmic Field Trips are designed to offer members the opportunity to experience the work of organisations pushing the boundaries of innovation.

Airmic's mentoring scheme is perfectly designed to help members develop their professional skillset, network with peers, and learn new skills and techniques to improve and grow in their careers.

Airmic is proud to work with selected affiliated providers delivering programmes relevant to Airmic members. Airmic has been able to secure discounts for members where possible.