An overview of insurance premium taxation across Europe

Christopher Bourdaire of Sovos | FiscalReps

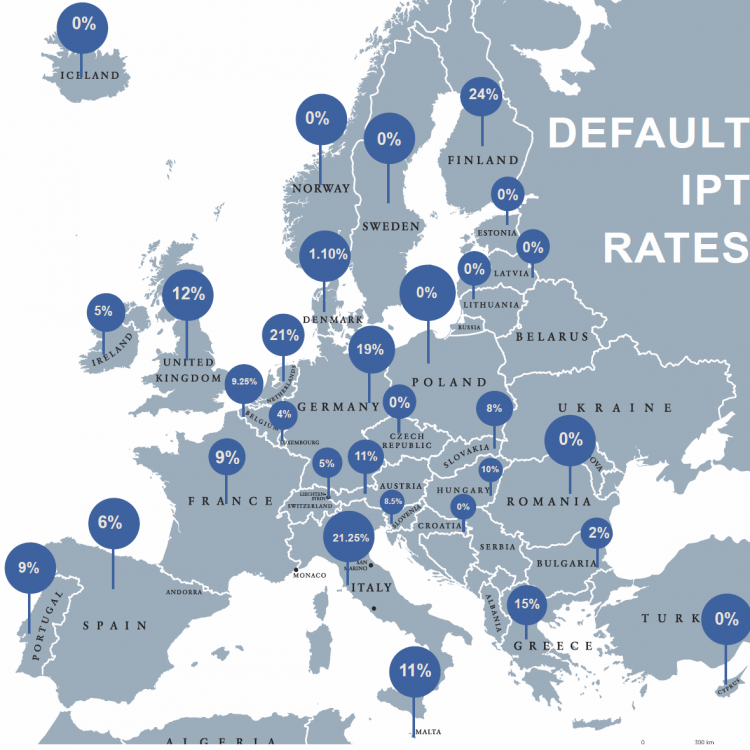

Until Brexit happens, the European Union (EU) remains composed of 28 territories, while the European Economic Area (EEA) includes three additional territories. Of these 31 territories, 22 currently levy an Insurance Premium Tax (IPT) or Stamp Duty (SD) on insurances written under the Freedom of Services (FoS) regime. It is worth noting that two territories - Croatia and Sweden - only tax specific businesses (Motor insurance in Croatia, Motor Liability insurance in Sweden).

If we consider the 20 territories that apply a tax on almost all non-life insurance premiums, we can see three trends:

- High taxation of insurance premiums: The first trend includes territories such as Finland (24%), Netherlands (21%) or Germany (19%), which have opted for IPT rates close or equal to the VAT rate in place in their territories

- Low taxation of insurance premiums: The second trend consists of territories such as Bulgaria (2%), Ireland (3%) or Luxembourg (4%), which have implemented low rates of premium taxes. However for specific risks, parafiscal charges can be added which slightly increases the amount of tax due

- Mixed taxation of insurance premiums: The last trend consists of territories that have opted for taxation based on the types of risk covered. This applies to France, where IPT rates range from 7% to 30%, and Italy, where IPT rates start from as low as 0.05% rising to a maximum of 21.25%. This trend may also soon include Slovakia, which is looking to switch from a single tax rate of 8% to multiple tax rates ranging from 4-18%.

While the tax rates are not subject to harmonisation at all (and this is unlikely to change in the coming years), some aspects of these regimes are common such as the collection of the tax being centralised at national level or the economic cost sitting firmly with the insured. However, these rules are not set in stone. For example, Hungary considers that IPT should be due by the insurer using a sliding scale based on the volume of premiums written, whilst Spain is the only country so far to allow some provincial authorities to collect the tax.

Territories without an IPT or SD regime

Among the nine EU/EEA territories not currently charging IPT on FoS business, several of them still require the filing of tax returns through the application of parafiscal charges on FoS insurance activity. This is the case for Cyprus (fixed fee SD), Iceland (parafiscal charges on Property insurance) and Poland (which levies a specific contribution to fund the Ombudsman services). Romania and the Czech Republic have a different approach as they currently do not tax FoS insurance activity but only the domestic market. Finally, this leaves us with Norway and the Baltic countries as the only EU/EEA territories that are not charging IPT, SD or parafiscal charges on insurance premiums.

Christophe Bourdaire is Senior Client Manager at Sovos | FiscalReps