White paper: Continuity Clauses: a guide for Airmic members

Introduction

As the date for the United Kingdom’s (UK) exit from the European Union (EU) gets ever closer, a variety of so-called ‘Continuity Clauses’ have emerged in the market. This guide explains the reasons for these clauses and what they aim to do.

Airmic members are encouraged to discuss the implications of Brexit for their insurance programme with their broker. To help those discussions, this guide aims to explain those Brexit issues of particular relevance to policyholders.

Part I: The current landscape

What is the concern around contract continuity and Brexit?

It currently seems most likely that UK and EEA insurers will no longer benefit from passporting rights after the UK exits the EU. This means that, post-Brexit (and as soon as 29 March 2019 if the UK fails to agree terms for its withdrawal), some insurers may not have the authorisation needed to perform their obligations and pay claims under certain insurance contracts. In particular, UK insurers may not have the authorisation needed to perform their obligations under contracts held by EEA policyholders. Paying claims without the relevant authorisation may be a criminal offence for the insurer.

There have been numerous calls for a solution to be found to this issue of contract continuity both from industry and from regulators within the UK and the EEA but as yet no agreement has been reached.

Which class of policy may be affected?

The issue can affect any class of insurance policy.

Do EEA insurers have the same concern about performing their obligations under contracts held by UK policyholders?

In general, the UK will default to treating EEA insurers in the same way as other non-EEA firms post-Brexit. However, in December 2017, the UK government took a unilateral decision to reassure EEA insurers that contract continuity would be safeguarded and that EEA insurers would be able to continue to operate in the UK post-Brexit. Specifically, the UK government will introduce a Temporary Permissions Regime (TPR) to enable EEA insurers to continue their activities in the UK for up to 3 years after withdrawal while they apply for full authorisation from the UK regulators.

The government has also made a commitment to ensuring that contractual obligations, such as insurance contracts, which are not covered by this temporary regime can continue to be met (although the precise scope of this promise remains unclear).

This position was reiterated in August 2018 when the UK government released its first batch of technical notes about the impact of a “no deal” scenario at the end of March 2019.

What has the EU said about the position of UK insurers?

The EU has not given the same concession to UK insurers, notwithstanding that such an approach would clearly be in the best interests of affected EEA policyholders.

The European Commission announced the following in July 2018 in relation to financial services contracts:

“in relation to contracts, at this juncture there does not appear to be an issue of a general nature linked to contract continuity [because] in principle, even after withdrawal, the performance of existing obligations can continue”.

Although it added:

“Every type of contract needs to be looked at separately.”

In contrast, EIOPA (European Insurance and Occupational Pensions Authority) published an opinion in June 2018 emphasising the need for insurers and insurance intermediaries to explain to policyholders how Brexit will affect their insurance cover. These comments built upon an opinion which it had published six months earlier which urged insurers to prepare for Brexit. EIOPA offered three solutions for UK insurers:

- Firms could establish an EEA subsidiary to act as a “hub” for their EEA business.

- The UK insurer could obtain authorisation for a third country branch in the relevant EEA jurisdiction(s). However, this approach carries with it the significant disadvantage that a third country branch (including an EEA branch of a UK insurer post-Brexit) has no passporting rights. Separately authorised branches would be needed, therefore, in every jurisdiction where there are policyholders; or

- For the UK insurer to transfer its affected policies to an EEA insurer, which would require a Part 7 FSMA transfer.

What is a Part 7 FSMA transfer?

Part 7 of the FSMA (the Financial Services and Markets Act 2000) establishes a regime for transferring insurance portfolios. It can be used to transfer insurance business across jurisdictions. A Part 7 transfer is a long and expensive process which requires a suitable transferee company to be found or, in some cases, established.

Policyholder interests are protected under a Part 7 transfer by the requirement for extensive regulatory (PRA and FCA) review of the process, court approval of the transfer and a requirement for an independent actuarial review of the implications of the transfer for policyholder interests.

What steps are insurers in fact taking to prepare for Brexit?

We have spoken to a range of insurers about their plans for Brexit. Any plans are, by their nature, bespoke to the particular insurer depending upon their current structure and arrangements. We are aware, for example, of:

- a number of UK insurers setting up new EEA insurance companies and carrying out Part 7 transfers of policies currently written out of existing EEA branches or covering EEA risks into those companies (the same outcome can be achieved through a Part 7 transfer into an existing EEA group company).

- some EEA insurers with UK branches applying to the UK regulators (FCA and PRA) for their UK branch to be authorised as a third country branch (although the introduction of the TPR should alleviate the need for applications before the UK’s exit from the EU).

What is the practical effect for a policyholder for each of the options a UK insurer may take?

The effect of either of these options is to ensure that, post-Brexit, the insurer under a particular policy has the authorisations it needs to meet its obligations to policyholders. This may be because the obligations have been transferred to an insurer which is located in another EEA state (under the first option above) or because the original insurer under the policy has obtained the authorisation it needs to conduct business in another jurisdiction (under the second option above).

Part II: Contract continuity clauses

What are contract continuity clauses?

We have seen a variety of clauses being proposed for use in policies. These aim to provide a level of contract continuity in the event that the UK leaves the EU without suitable transitional arrangements being put in place or without an agreement allowing UK insurers to perform cross-border business into the EEA.

To avoid creating uncertainty, it is important that the clauses are consistent with the relevant insurer’s plan for mitigating the impact of Brexit. There is no one size that fits all. Indeed, given the steps being taken by some insurers to prepare for Brexit these clauses may not be necessary in a number of policies.

What do continuity clauses do?

There are a number of different clauses being used in the market. In a number of these, provision is made for the policy to be transferred from the Insurer (Original Insurer) to another authorised insurer (Replacement Insurer) in the event that the Original Insurer is/will no longer be authorised to service the policy after Brexit. The clauses we have seen achieve this in different ways. There is a question as to whether some of these clauses may circumvent Part 7 of the FSMA.

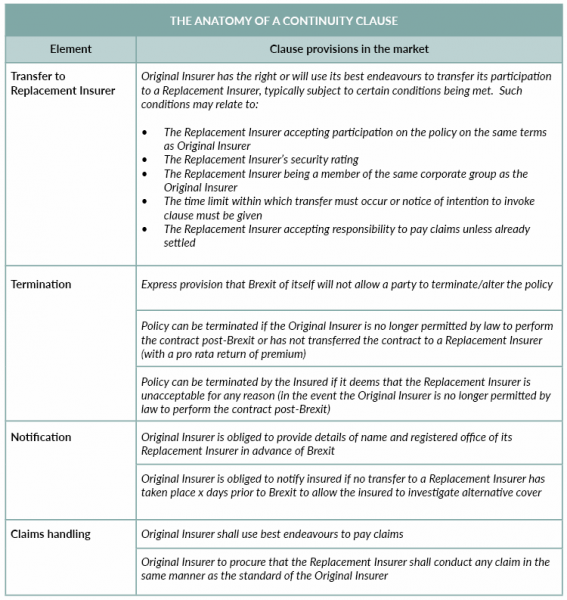

Whilst the clauses vary in their detail and wording, there a number of key elements that we have identified across the clauses we have looked at:

It is important to note that not all of the contract continuity clauses we have seen contain all of these elements. Airmic members should consider carefully which elements any proposed continuity clause has when negotiating these clauses.

Issues to consider include:

- What do you want to happen in the event the Original Insurer is/will no longer be authorised to service your policy after Brexit?

- Do you want to be able to terminate the policy with the Original Insurer and seek alternative cover yourself? Would that be helpful to you?

- Are you happy for the policy to be transferred to a Replacement Insurer in the event the Original Insurer is/will no longer be authorised to service the policy after Brexit?

- If a transfer is proposed, what protections do you want around the identity of any Replacement Insurer and, for example, its security rating? Will the Original Insurer be required to seek your consent or does the clause propose a transfer at the Insurer’s election?

- What comfort have you got around how any Replacement Insurer will handle and settle claims?

What should Airmic members be doing?

The advice to Airmic members is to discuss the implications of Brexit on your insurance programme with your broker – both your existing programme and any renewable/new policies that are due to be purchased. Not all insurance contracts will be affected by Brexit.

For existing policies, the impact of Brexit will depend on the relevant insurer’s plans. They may well be taking steps to mitigate or negate the risks associated with contract continuity which avoid the need for a continuity clause at all.

Those renewing or purchasing new policies in the lead-up to Brexit should be given the information they need pre-contract to make an informed decision about any risks associated with buying cover from a particular insurer. It is here that the role of the broker will clearly come to the fore, in particular, in recommending insurers for the provision of cover and advising on the terms of any proposed continuity clauses.

Herbert Smith Freehills is a full service international law firm with a market leading insurance practice. The firm has been Airmic’s Preferred Service Provider on insurance law issues for many years and has assisted Airmic in preparing various technical guides for its members.

Herbert Smith Freehills lawyers have an outstanding reputation in complex, high profile insurance disputes and for providing strategic legal advice and representation to corporate policyholders. The firm assists with the resolution of major claims across all classes of policy as their core expertise, including advice on coverage, claim project management and claims advocacy to secure appropriate settlement of claims using the full range of dispute resolution procedures including litigation, arbitration and all the forms of Alternative Dispute Resolution. This unrivalled hands-on experience of coverage disputes informs Herbert Smith Freehills’ approach to policy wording reviews and drafting. The team also advise on the interface between insurance and contractual risk allocation regimes in commercial contracts.

Herbert Smith Freehills’ large dedicated contentious insurance practice is ranked as top-tier in both Chambers UK and Legal 500 in representing policyholders in the largest most complex coverage disputes in the London and international market.

Herbert Smith Freehills is happy to discuss any queries that members may have about this guide. Please contact Sarah Irons (sarah.irons@hsf.com).

This briefing has been produced with the assistance of Herbert Smith Freehills LLP as a preferred service provider to Airmic. The content of the briefing relates to the position under English law and does not constitute legal advice. Members are advised to consult their lawyers should they require advice on any matter that is the subject of this briefing.

- Fill out an application Our membership manager will assess your eligibility against our criteria.

- Complete your profileIf you are eligible for membership you will be asked to answer a few questions about yourself.

- PaymentYou can make payment online using a card or request an invoice.