The Harsh Market with a Focus on Claims

Introduction

Download the report findings here

Airmic is conducting a series of Pulse Surveys among its members, focused on insurance market conditions. The latest survey conducted in January 2021 focused on renewals and claims, and found an increasing challenge to claims – but where claims had been settled, members have generally had a satisfactory experience. Premium rates, and the scope of cover and capacity, have continued to deteriorate across a number of covers and sectors. The trend towards the increasing use of existing captives, and the creation of new captives, has continued.

This report is set in the context of the UK Supreme Court’s judgment in the case brought under the Financial Markets Test Case scheme by the Financial Conduct Authority (FCA) against eight insurers, which considered the extent to which business interruption (BI) coverage was available under a selection of ‘non-damage’ BI extensions provided in a sample of policy wordings. The Supreme Court found in favour of policyholders, essentially upholding the findings of the High Court and, in some cases, broadening the coverage available for Covid-19 BI losses. The handing down of the judgment took place after most of the survey responses had been received.

The January 2021 Pulse Survey canvassed members of the Airmic Leadership Group of risk professionals and insurance buyers. The survey ran over two weeks between 7 and 22 January and asked 17 questions.

Each Pulse Survey comprises a combination of questions designed to track market conditions, supplemented by a focus on specific subjects. In the latest survey, the questions focused on the claims experience of Airmic members. Four headline findings included:

- Almost half of respondents have seen an increase in challenges to their claims throughout 2020.

- Where claims were paid out by insurers though, the claims service experience, the speed and amount of the payout had generally met the expectations of Airmic members.

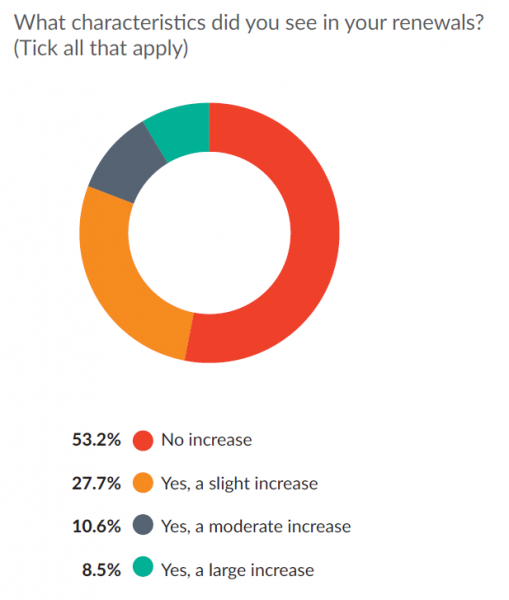

- More respondents report that they are seeing reduced cover capacity, increases in cover exclusions, and poor and late communication from insurance partners.

- Since the UK and the EU reached a post-Brexit deal in December 2020, Airmic members are most concerned that there will be additional costs to their organisations, in terms of buying insurance.

- Fill out an application Our membership manager will assess your eligibility against our criteria.

- Complete your profileIf you are eligible for membership you will be asked to answer a few questions about yourself.

- PaymentYou can make payment online using a card or request an invoice.