EXPLAINED: Complex property claims

Introduction

The insurance manager has the responsibility of managing a major claim. The outcome is the true acid test of any insurance programme purchased by an organisation and, for the insurance manager, it can be a career-defining moment.

A slow, mismanaged claim can be frustrating on a personal level, but also catastrophic to the organisation. There is a need to ensure financial stability - protecting the share price and obtaining coverage affirmation quickly is usually paramount to ensure that there is no risk to the organisation’s ability to compete in the long term. In the increasingly complex, transparent and digital world insurance managers will need to consider the implications of a major event on their internal and external stakeholders too.

Figures vary, but Zurich states that large organisations only suffer a truly ‘major loss’ once every 10 years, meaning that for many Airmic members, they haven’t yet been tested in this way. Being at the centre of a major claim can be a huge challenge for an insurance manager and involves a significant shift in their responsibilities and role in the business.

‘The rubber really hits the road when there is a major claim and the insurance manager essentially becomes ‘a target’. This can be an unpleasant experience as their role will change from being the one who asks the questions, to the one being asked all the questions. You can never be ‘over-prepared’.’

Colin Campbell, Head of Risk & Compliance, Arcadia

Airmic regularly surveys its members and sponsors on why claims are challenged or fail, with the following always scoring highly:

- Appropriate cover wasn’t in place

- Lack of available data to evidence the claim

- Failure to comply with conditions, particularly claims conditions precedent to liability

Once a loss has occurred, it is too late to rectify the cover in place. However, Airmic members are encouraged to have clearly established claims procedures to help avoid challenges based on data and compliance with policy terms.

This Airmic paper highlights the consequences of a major property damage event, the challenges that an insurance manager will face, and the stakeholders they will need to interact with internally and externally.

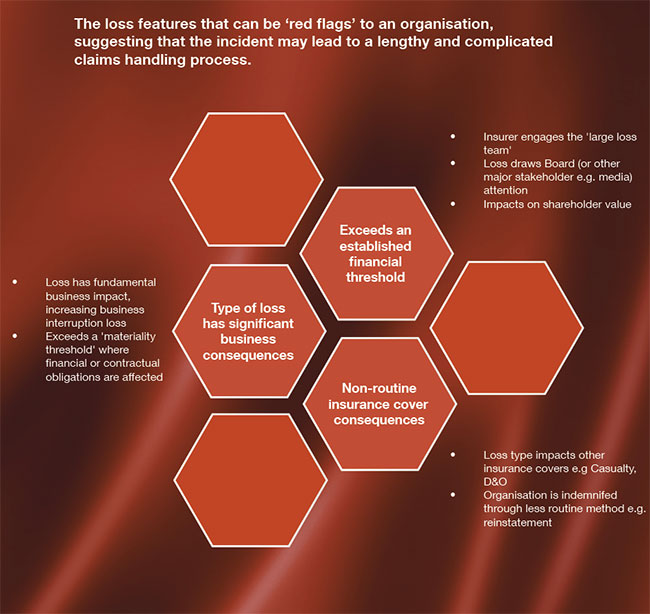

What is a complex claim?

A major or complex loss is hard to define as no claim is the same.

‘Even if in financial terms a loss is small, if it has the effect of ‘stopping the tills’, we consider it a major loss and treat it accordingly.’ Robert Lewis, Claims Leader for the Risk Management Practice, Marsh

- Fill out an application Our membership manager will assess your eligibility against our criteria.

- Complete your profileIf you are eligible for membership you will be asked to answer a few questions about yourself.

- PaymentYou can make payment online using a card or request an invoice.