White paper: Parametric solutions

Introduction

Against a backdrop of disruption to business models, a shift from tangible to intangible assets and associated changes to risk profiles, risk managers are seeking new products and services appropriate to the modern world. Boards are demanding that insurance managers find solutions for risks previously incompatible with the traditional market. Therefore, the potential of parametric insurance solutions is increasingly considered.

The benefits are undeniable: transparency of cover, speed of settlement, flexibility of design. However, there are stories of organisations investing time and resource in investigating these solutions and the deal not making it over the line.

This paper, developed with Swiss Re Corporate Solutions, Marsh and a group of risk managers, will look at the challenges faced when purchasing parametric insurance solutions and how these can be overcome.

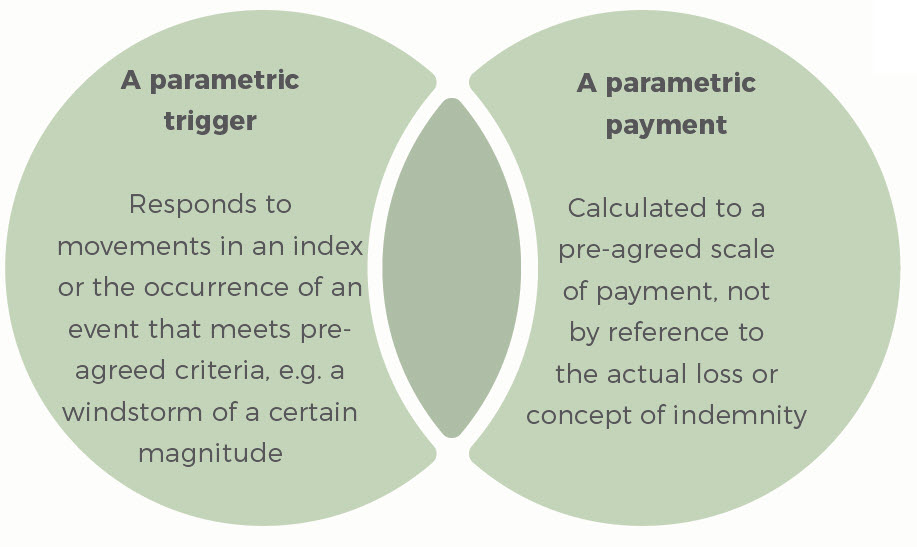

Parametric solutions: A quick reminder

Parametric solutions seek to provide clarity of cover by minimising the basis risk of traditional indemnity policies, i.e. the risk of a mismatch between the policyholder’s coverage expectations and the actual indemnity payment made under the contract.

They provide a welcome injection of almost immediate liquidity into the business at a time of crisis, required for essential operational and recovery costs, without the extensive scrutiny of indemnity policies. This is invaluable in today’s world where businesses can be heavily leveraged and maintaining a good reputation with lenders, investors and other stakeholders is critical.

| Traditional indemnity insurance | Parametric solutions | |

| Trigger | Loss or damage to a physical asset | Occurrence of an event that exceeds a parametric threshold |

| Recovery | Reimbursement of the actual loss suffered | Pre-arranged payment |

| Basis risk | Arises from policy conditions and exclusions | Arises from the correlation of the data and the index with the risk |

| Claims process | Can be complex and involve multiple parties | Transparent and quick |

| Structure | Generally standardised products with some customisation available | Flexible, customised products |

Source: Swiss Re Corporate Solutions

The challenges

An initial high level of commitment by organisations is required to understand and develop these new solutions. Risk managers will need to acquire new skills and have different conversations across all levels of the business.

- Identifying where a parametric solution is relevant to the business model

- Providing reliable, independent data that correlates the business model to the risk

- Communicating the product to the business and gaining internal support for the cost.

Assessing the business model

Parametric solutions can cover loss events previously deemed uninsurable or, more regularly, close gaps in traditional polices created by exclusions or sub-limits. Knowing where to start is a challenge. A first step must be throwing away the traditional view of ‘insurable perils’ and the backward-looking approach of studying previous events. Getting to grips with the business model and assessing the cash-flow interdependencies of the business must be the starting point.

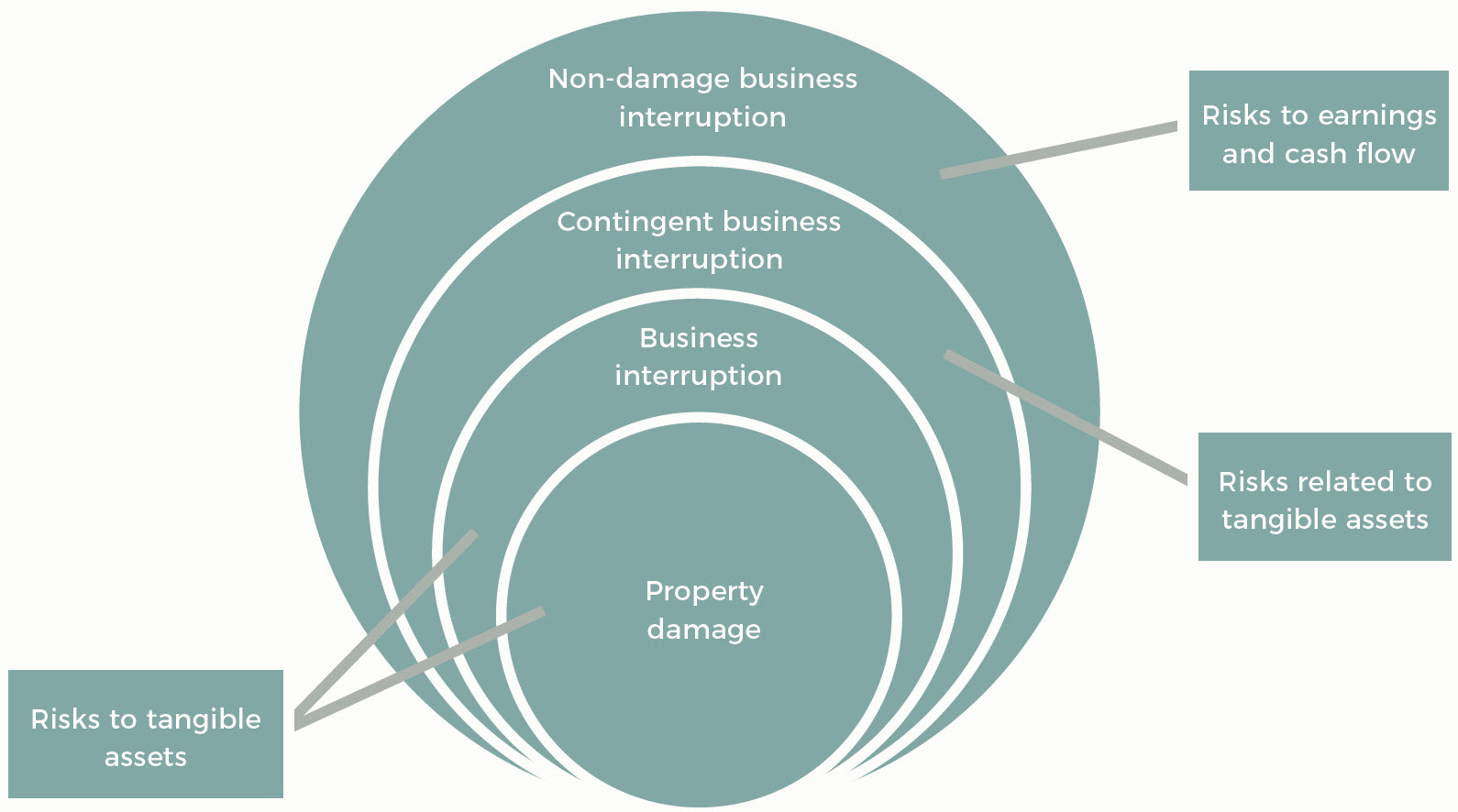

Risk managers will need to be more confident in understanding the organisation’s business model and strategy. They must be able to identify not just the risks to the tangible assets of the business but the risks to the earnings and cash flows, as described in figure 1.

Figure 1: The expanding scope of first-party risks (Adapted from Swiss Re Institute)

Linking risk management and strategy

- Understand the business model and risk register

- Identify the risks posed to intangible assets and their associated risks

Consider where parametric solutions can provide extra capacity or a needed burst of cash - Engage the CFO and business units to understand the business’s profit streams and cash flows and their interdependencies

- Understand the key processes and systems that underpin these cash flows

- Identify any external event that may disrupt these processes, including review of all remaining risks on the risk register

Parametric solutions can provide protection against previously uninsurable risk, so take nothing off the table. Cover has historically provided for weather and natural catastrophe risks, but, solutions for man-made risks are becoming increasingly popular - Go beyond the business and assess the supply chain and its risks too.

Consider the potential for cover for suppliers located in catastrophe-prone areas.

“Alongside the modern man-made insurance risks, the current progress in digital technology and the availability of large amounts of data has brought risk modelling to new levels. As insurers, we are able to accurately quantify the probabilities of previously difficult-to-insure risks and are happy to discuss creative new solutions.” Christian Wertli, Swiss Re Corporate Solutions

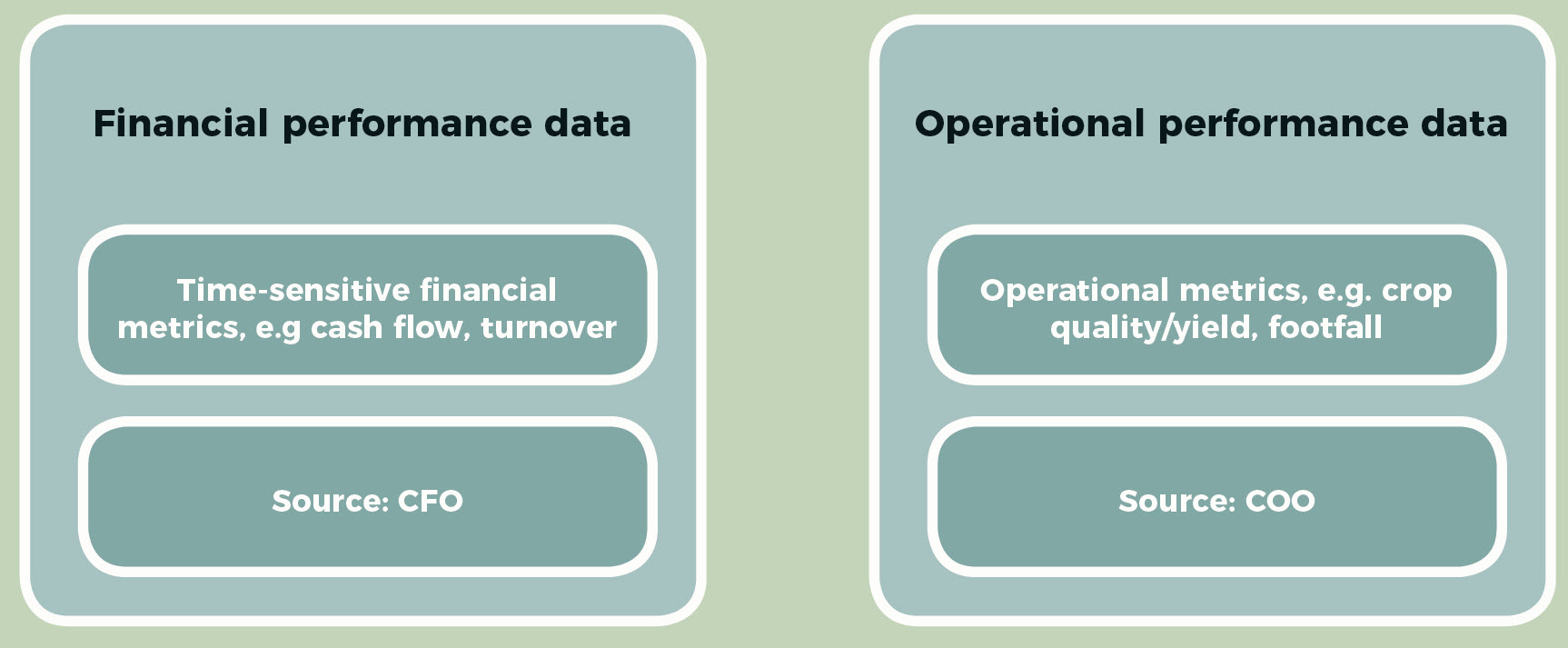

Providing the data

Collecting data to develop a parametric solution can be cumbersome. The data is unlikely to come via the internal channels the insurance manager is used to operating through. The challenge is two-fold:

- The index

Finding a data source that provides independent, reliable and consistent information to create an index for the chosen hazard.

The data must have been captured over a suitable period to support underwriting and must continue to be collected over the duration of the policy.

The broker and insurer can help. Traditionally, indices have been gathered from external sources, e.g. precipitation, temperature or ‘snow day’ information from weather stations or earthquake shake intensity from appropriate bodies. However, innovations, including terrorism and pandemic solutions, have been covered and insurers are now looking at the implications for cyber and reputational damage. If data is being collected externally or internally, it’s worth pursuing.

- The link to business performance

Evidencing the correlation between the trigger metric and the loss exposure of the business. However, once the evidence is achieved, the price of cover will be determined on data modelling, reducing the amount of information required to determine exact risk exposure.

Risk managers must articulate the data required and the reason for collecting.

Risk managers must be specific when asking for data from the business. Data must be collected with purpose, reliable and consistently collected over time.

Parametric solutions require a shift in mindset

Gaining internal support

Organisations expect affordable premiums and cover that sufficiently decreases the risk exposure. Purchases of parametric solutions can stumble at the last hurdle: cost. There is concern that insurance is increasingly thought of as a commodity purchase by Boards and they can overly focus on minimising premium.

Where a parametric solution provides cover for a previously uninsured risk, additional cost is inevitable. However, Boards and senior managers often prefer to focus on better understood internal controls rather than new insurances. The insurance buyer must describe the cover available in a way that resonates with the business and manage cost expectations early.

Again, the CFO will be a crucial ally. The insurance manger must use the CFO’s expertise to help describe the protected loss events in terms of the total cost of risk and how this relates to the financial strategy.

- If the risk event were to occur, what would the maximum expected loss be?

- What would the subsequent strain on the cash flow be?

- What is the risk tolerance of the organisation, how great a loss can it sustain?

- At what loss value would different financial actions be required, e.g. additional lending, reduced dividend payments or stock market notifications?

When communicating to the Board, the insurance manager should highlight the following:

- The risk events covered are likely to be difficult to manage/prevent.

- The risk events covered may be more frequent than traditionally insured events, i.e. 1 in 5 years rather than 1 in 20 years.

- The product is therefore ‘closer to the money’ and priced accordingly.

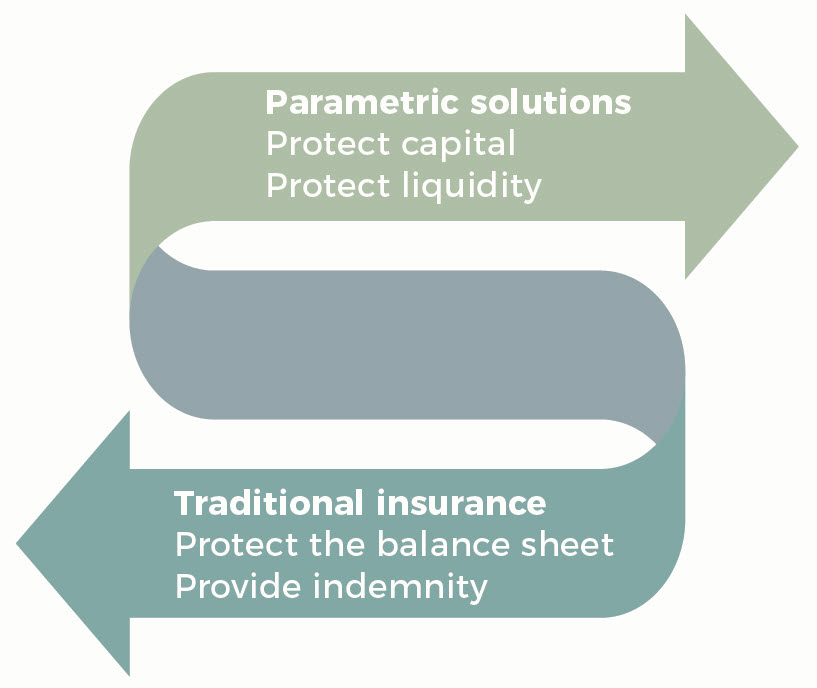

- Parametric solutions protect capital and performance volatility, a key concern of senior management.

- Products are tailored to the financial performance and operating environment of the organisation. They are bespoke products that competitors are unlikely to have.

The future

Purchasing a parametric solution requires a different approach to traditional insurance purchasing. To ease the burden, some organisations are easing into this new world through modifying (‘parameterising’) the additional increased cost of working elements of their BI policy or by testing parametric coverage in their captive.

Airmic members have expressed interest in incorporating a parametric trigger to their general insurance programme by linking this to a deductible. An organisation may take on a more sizeable retention than normal, but this retention drops if a parametric trigger event is met. For example, an airline would maintain a high retention in general conditions. However, if an ash cloud occurred and grounded flights, that retention would drop to a more manageable level.

“Integrating a parametric trigger into the operation of a retention would allow the policy to adapt to the financial position of the business. When times are good, the retention is high and, in pre-agreed ‘difficult’ conditions, the policy would adapt to meet the commercial strain.” Steve Harry, Marsh

About Marsh

A global leader in insurance broking and innovative risk management solutions, Marsh’s 30,000 colleagues advise individual and commercial clients of all sizes in over 130 countries. Marsh is a wholly owned subsidiary of Marsh & McLennan Companies (NYSE: MMC), the leading global professional services firm in the areas of risk, strategy and people. With annual revenue over US$13 billion and more than 60,000 colleagues worldwide, MMC helps clients navigate an increasingly dynamic and complex environment through four market-leading firms. Follow Marsh on Twitter @MarshGlobal; LinkedIn; Facebook; and YouTube, or subscribe to BRINK.

About Swiss Re Corporate Solutions

Swiss Re Corporate Solutions provides risk transfer solutions to large and mid-sized corporations around the world. Its innovative, highly customised products and standard insurance covers help to make businesses more resilient, while its industry-leading claims service provides additional peace of mind. Swiss Re Corporate Solutions serves clients from over 50 offices worldwide and is backed by the financial strength of the Swiss Re Group. For more information about Swiss Re Corporate Solutions, visit corporatesolutions.swissre.com or follow us on linkedin.com/company/swiss-re-corporate-solutions or Twitter @SwissRe_CS.

- Fill out an application Our membership manager will assess your eligibility against our criteria.

- Complete your profileIf you are eligible for membership you will be asked to answer a few questions about yourself.

- PaymentYou can make payment online using a card or request an invoice.