Practical Guide to Corporate Planning for Brexit

Article provided by AIG

Airmic members received a practical briefing on preparing for the EU Referendum at a roundtable for members hosted by AIG. Whilst there are many unknowns in terms of the outcome of the referendum, and the impact of a potential vote for either in or out, there are steps that risk directors can take to prepare their businesses and their Boards.

AIG’s head of UK legal James Middleton explained the potential timeline if the UK votes to leave the EU, referencing the 2 year period for negotiating an exit outlined in the Lisbon treaty, although all speakers agreed the timeline for negotiating a new arrangement with the EU is not clear.

James Middleton

He outlined various possible scenarios:

- “The Norway Option”: The UK leaves the EU and becomes a member of the European Economic Area and the European Free Trade Association (EFTA). All four current EFTA members would have to consent. Under this arrangement, the UK would be required to implement the majority of EU legislation (main exceptions include fisheries, farming, foreign and security policy). For Financial Services, passporting would be maintained i.e. freedom of establishment and freedom of services, which enables the establishment of branches across the EEA and access to sell insurance policies from any branch into any other member state plus EFTA countries.

- “The Swiss Option”: The UK leaves the EU but agrees sector-by-sector treaties with the EU, and free trade agreements with the EFTA countries. There are currently over 120 bilateral agreements in force between Switzerland and the EU. The Swiss model does not cover access to the Internal Market for Financial Services (other than for branches of non-life insurers).

- "The Turkey Option": The UK would enter into a Customs Union with the EU, providing access to the EU Internal Market for goods. The UK would be required to impose the EU common external tariff on imports from outside the UK/EU customs union and abide by EU state aid and competition rules. This option does not cover services.

- WTO Option: Membership of the EU currently enables access to over 50 EU Free Trade Agreements with third countries, which may need to be renegotiated under the ‘WTO’ Option. The UK would not be part of the EU single market and would not be bound by single market rules. UK exports to the EU would be subject to the EU’s common external tariff.

Paul Barrett

The CBI’s director of campaigns, Andy Bagnall, picked up the discussion by indicating that only about 50% of FTSE companies have made contingency plans. That percentage was mirrored almost exactly by the proportion of risk managers in the room who said, on a show of hands requested by Airmic deputy CEO Julia Graham, that they had Brexit on their radars. There is a significant variance in levels of preparedness between sectors, with financial services well advanced and other sectors with some way still to go. Part of this, in Bagnall’s words, is because “we don’t know what ‘out’ will look like. There’s very little hard fact.”

However, in the words of Paul Barrett, Head of Risk Framework and Regulatory Strategy at AIG Europe, the role of risk management is “to translate uncertainty into a measure of defined outcomes.” Barrett recommended that companies look at the potential areas of impact and consider the short- medium- and long-term consequences.

Barrett also recommended that attendees broke down the potential impact by considering different areas of their business, including HR, Sales, Risk, Regulation, Sales, Corporate Governance and Legal impact. He particularly highlighted the importance of ensuring a clear and pre-agreed communication plan was in place for external audiences and staff.

Andy Bagnall

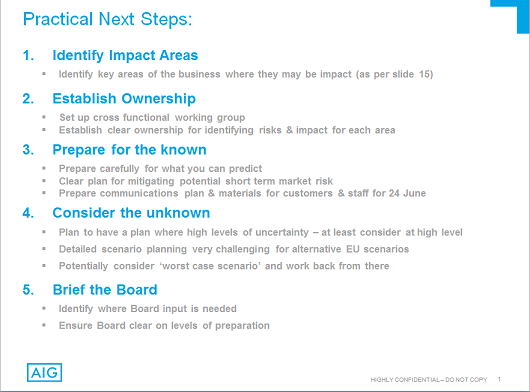

Attendees were left with a set of practical next steps to consider when preparing their business for the referendum:

PREPARING FOR THE EU REFERENDUM – PRACTICAL NEXT STEPS

Source AIG